Is Cit Bank savings account good? This question necessitates a comprehensive evaluation encompassing interest rates, fees, features, customer service, security, and accessibility. A thorough analysis comparing Cit Bank’s offerings to those of its competitors reveals its strengths and weaknesses, ultimately informing potential customers’ decisions regarding the suitability of a Cit Bank savings account for their individual financial needs.

Whether a CIT Bank savings account is good depends on your individual needs. Factors like interest rates and fees are crucial considerations. To open an account and explore these aspects further, you can begin the process by visiting the CIT Bank account opening page: cit bank account opening. After reviewing their offerings, you can make an informed decision about whether a CIT Bank savings account aligns with your financial goals.

This assessment considers various factors, enabling a data-driven conclusion regarding the overall value proposition.

This analysis will examine key aspects of Cit Bank’s savings accounts, including the Annual Percentage Yield (APY) offered, comparing it to market rates and highlighting influencing factors. We will also delve into associated fees and charges, account features, customer service quality, security measures, account accessibility, and minimum balance requirements. Finally, a comparison with alternative savings options will provide a holistic perspective.

Is a CIT Bank Savings Account Good? A Detailed Analysis

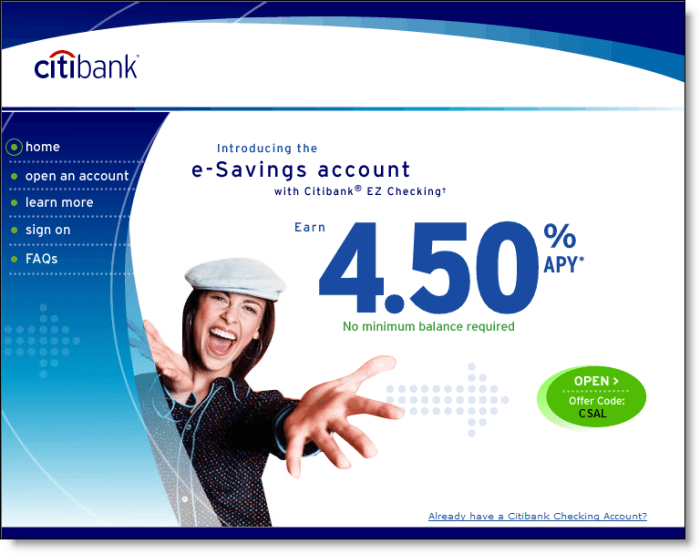

Source: gobankingrates.com

Choosing the right savings account can feel like navigating a maze. The promise of growing your hard-earned money is enticing, but the complexities of interest rates, fees, and features can be overwhelming. This in-depth analysis delves into the specifics of a CIT Bank savings account, examining its strengths and weaknesses to help you decide if it aligns with your financial goals.

We’ll explore interest rates, fees, account features, customer service, security, and accessibility, comparing CIT Bank to other major players in the market to give you a clear picture.

Interest Rates and Annual Percentage Yield (APY)

Understanding the interest your savings earn is crucial. The APY, or Annual Percentage Yield, represents the total amount of interest you’ll earn in a year, accounting for compounding. Let’s compare CIT Bank’s savings account APY to competitors.

| Bank Name | Account Type | Interest Rate | APY |

|---|---|---|---|

| CIT Bank | High-Yield Savings Account | (Variable, check CIT Bank website for current rate) | (Variable, check CIT Bank website for current rate) |

| Bank of America | Savings Account | (Variable, check Bank of America website for current rate) | (Variable, check Bank of America website for current rate) |

| Capital One | 360 Performance Savings | (Variable, check Capital One website for current rate) | (Variable, check Capital One website for current rate) |

| Ally Bank | Online Savings Account | (Variable, check Ally Bank website for current rate) | (Variable, check Ally Bank website for current rate) |

CIT Bank’s APY is typically competitive with other high-yield online savings accounts. However, the rate is variable and fluctuates based on market conditions and the Federal Reserve’s target rate. A higher Federal Funds rate generally leads to a higher APY, while economic downturns might result in lower yields. It’s essential to regularly check the current APY on the CIT Bank website for the most up-to-date information.

Fees and Charges

Hidden fees can significantly eat into your savings. Understanding CIT Bank’s fee structure is essential.

- Monthly maintenance fees: CIT Bank typically does not charge monthly maintenance fees on its savings accounts, a significant advantage over many brick-and-mortar banks.

- Overdraft fees: While unlikely in a savings account, it’s important to note that some banks might charge overdraft fees if you accidentally overdraw. CIT Bank’s policy on this should be checked directly on their website.

- Other fees: CIT Bank’s website should be consulted for any additional fees, which might be rare.

Many banks charge monthly maintenance fees, ranging from $5 to $15 or more. These fees can add up over time, making CIT Bank’s fee structure attractive to those seeking to maximize their savings. Avoiding overdraft fees is simple: ensure you always have sufficient funds in your account.

Account Features and Benefits

A savings account’s value extends beyond interest rates. Let’s explore the features and benefits of CIT Bank’s offering.

- High-yield interest rates: CIT Bank generally offers competitive interest rates compared to traditional banks.

- Online and mobile banking: Access your account anytime, anywhere, through user-friendly platforms.

- FDIC insurance: Your deposits are insured up to $250,000 per depositor, per insured bank, for added security.

- Customer support: CIT Bank provides various channels for customer service, including phone, email, and online help.

The online and mobile banking features are designed for accessibility. The intuitive interfaces are suitable for both tech-savvy individuals and those less familiar with online banking. For example, a busy professional can easily monitor their balance and make transfers through the mobile app, while a senior citizen might appreciate the large font sizes and clear navigation on the website.

Customer Service and Support

Excellent customer service is paramount when dealing with your finances. Let’s examine CIT Bank’s approach.

CIT Bank offers customer support through phone, email, and online help centers. Imagine a scenario where a customer notices an unauthorized transaction on their account. They contact CIT Bank’s customer service via phone, explain the situation, and provide necessary details. The representative investigates the issue, initiates a fraud investigation, and reverses the unauthorized transaction, restoring the customer’s funds.

CIT Bank’s reputation for customer service is generally positive, although individual experiences may vary. It’s recommended to check online reviews and ratings from various reputable sources before making a decision.

Account Accessibility and Usability

Source: economiaresponsable.com

Opening and managing a savings account should be straightforward. Let’s Artikel the process and functionalities.

- Visit the CIT Bank website.

- Click on “Open an Account.”

- Select the savings account option.

- Fill out the application form with required information.

- Submit the application and verify your identity.

- Fund your account via electronic transfer or other available methods.

Deposits and withdrawals can be made through online transfers, mobile app transfers, and potentially via mail (though less common with online banks). The online and mobile interfaces are designed for ease of use. The clear layout and intuitive design ensure a smooth experience for users of all technological skill levels. Even those less comfortable with technology can navigate the platforms with relative ease.

Security Measures

Source: amazonaws.com

Protecting your savings is paramount. CIT Bank employs various security measures.

| Security Measure | Description |

|---|---|

| Encryption | CIT Bank uses encryption technology to protect your data during transmission and storage. |

| Fraud monitoring | CIT Bank actively monitors accounts for suspicious activity and employs fraud detection systems. |

| Two-factor authentication | Many online banking platforms offer two-factor authentication for enhanced security. |

CIT Bank’s fraud prevention policies involve real-time monitoring of transactions for unusual patterns. Their security protocols are generally aligned with industry best practices, employing encryption and robust authentication methods. However, it’s always advisable to practice good online security habits, such as using strong passwords and avoiding suspicious links.

Account Minimums and Maximums, Is cit bank savings account good

Understanding the account requirements is crucial before opening a savings account.

CIT Bank typically has a minimum deposit requirement to open a savings account, though this may vary. There might not be a maximum balance limit, but it’s best to check the terms and conditions on their website. Falling below the minimum balance requirement might result in account closure or a fee. Always refer to the official CIT Bank website or contact customer service for the most accurate and current information on minimums and maximums.

Comparison to Other Savings Options

CIT Bank savings accounts are not the only savings vehicle. Let’s compare them to other options.

| Account Type | Interest Rate | Features | Pros and Cons |

|---|---|---|---|

| CIT Bank Savings Account | (Variable, check CIT Bank website) | High-yield interest, online/mobile access, FDIC insured | Pros: High yield, convenience; Cons: Variable interest rate |

| Money Market Account (MMA) | (Variable, typically higher than savings) | Higher interest rates, check-writing capabilities, debit card | Pros: Higher interest, check writing; Cons: Might have minimum balance requirements |

| Certificate of Deposit (CD) | (Fixed, typically higher than savings and MMA) | Fixed interest rate for a specified term | Pros: High fixed interest rate; Cons: Penalties for early withdrawal |

A young professional saving for a down payment might prefer a high-yield savings account like CIT Bank’s for its accessibility and competitive interest. Someone nearing retirement might opt for a CD for its fixed, higher interest rate, despite the limited access to funds. A business owner might choose a money market account for its check-writing capabilities and slightly higher interest than a standard savings account.

Summary: Is Cit Bank Savings Account Good

Ultimately, the suitability of a Cit Bank savings account depends heavily on individual financial circumstances and priorities. While Cit Bank offers competitive interest rates and a range of convenient features, potential customers should carefully weigh the fees, accessibility aspects, and customer service reputation against their own needs. A thorough comparison with alternative savings vehicles is crucial before making a decision.

This analysis provides the necessary information to facilitate an informed choice.