CIT Bank ACH transfer limit: A seemingly mundane phrase, yet it holds the key to unlocking the smooth flow of your financial energy. Understanding these limits isn’t just about numbers; it’s about aligning your financial intentions with the cosmic rhythm of transactions. This exploration unveils the subtle mechanics behind ACH transfers, revealing how to harmonize your financial aspirations with the system’s inherent structure.

We’ll navigate the intricacies of daily, weekly, and monthly limits, exploring the factors that influence these boundaries and the path to expanding them.

This journey delves into the heart of your financial landscape, revealing how your account history, verification status, and account type interact to shape your ACH transfer capacity. We will examine the process of requesting limit increases, the potential hurdles, and the consequences of exceeding these carefully defined boundaries. By understanding the energetic flow of your finances, you can cultivate a deeper connection to your wealth and manifest abundance.

Understanding CIT Bank ACH Transfer Limits

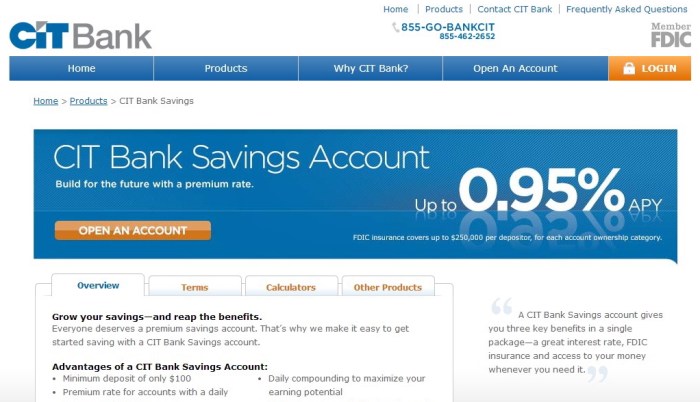

CIT Bank offers Automated Clearing House (ACH) transfers, a convenient method for electronic fund transfers. However, understanding the limits associated with these transfers is crucial for efficient financial management. This section details CIT Bank’s ACH transfer limits, the factors influencing them, and the procedures for increasing these limits.

CIT Bank’s ACH Transfer Options

CIT Bank provides various ACH transfer options catering to different financial needs. These include transfers between CIT Bank accounts, transfers to external accounts, and potentially payroll direct deposits. The specific types of ACH transfers available may vary based on the account type (personal or business).

Factors Determining ACH Transfer Limits

Several factors influence the individual ACH transfer limits set by CIT Bank. These factors ensure responsible banking practices and mitigate potential risks.

- Account History: A consistent history of responsible banking, including on-time payments and adherence to existing account limits, generally leads to higher transfer limits.

- Account Verification: Thorough verification of account information, including identity and address, plays a significant role in determining the initial and subsequent ACH transfer limits.

- Account Type: Business accounts often have higher ACH transfer limits compared to personal accounts, reflecting the higher transaction volumes typically associated with business operations.

- Transaction Patterns: Frequent and large ACH transfers might trigger a review of the account’s limit, potentially leading to an adjustment.

Daily, Weekly, and Monthly ACH Transfer Limits

CIT Bank’s ACH transfer limits are typically structured on a daily, weekly, and monthly basis. Precise limits vary based on the factors discussed above. While specific numbers aren’t publicly available, it’s common for personal accounts to have lower limits than business accounts. For example, a personal account might have a daily limit of $10,000, a weekly limit of $25,000, and a monthly limit of $50,000.

Business accounts may see significantly higher limits.

Examples of Transactions Counted Towards ACH Limits

Several transaction types contribute to the daily, weekly, and monthly ACH transfer limits. Understanding these is key to managing your transfers effectively.

- Direct Deposits: Payroll direct deposits are counted towards the ACH limit.

- Bill Payments: Automated bill payments made via ACH are included in the limit.

- Peer-to-Peer Transfers: Transfers to other accounts using ACH-based services count towards the limit.

- Wire Transfers (if processed as ACH): Some wire transfers might be processed through the ACH network, thus contributing to the limit.

Increasing Your ACH Transfer Limit: Cit Bank Ach Transfer Limit

Should your current ACH transfer limits prove insufficient, you can request an increase from CIT Bank. The process typically involves providing supporting documentation and demonstrating a need for a higher limit.

Requesting a Limit Increase

To request an increase, contact CIT Bank’s customer service department. They will guide you through the process and provide the necessary forms. Be prepared to explain the reasons for the requested increase and provide supporting documentation.

Understanding CIT Bank’s ACH transfer limits is crucial for efficient fund management. The availability of alternative payment methods, such as virtual cards, can influence transfer strategies; for instance, the question of whether does TD Bank have virtual cards impacts how one might approach exceeding CIT Bank’s ACH limits. Therefore, a comprehensive understanding of both systems is necessary for optimal financial planning.

Documentation for Limit Increase Requests

Source: creditdonkey.com

The required documentation may vary, but generally includes:

- Proof of Business Need (for business accounts): This might involve financial statements, business plans, or other relevant documents showcasing the need for higher transfer limits.

- Account History: Providing a record of your consistent and responsible banking history can strengthen your request.

- Identification Documents: Valid identification documents may be required to verify your identity.

Limit Increase Approval Process, Cit bank ach transfer limit

CIT Bank reviews limit increase requests on a case-by-case basis. The approval process involves verifying the provided information and assessing the risk associated with increasing the limit. The review process may take several business days.

Reasons for Limit Increase Denial

Several factors can lead to a denial of a limit increase request. These might include:

- Insufficient Account History: A short or problematic account history might raise concerns.

- Incomplete Documentation: Failure to provide the necessary documentation can lead to delays or denial.

- High-Risk Activities: If CIT Bank detects potentially high-risk activities on the account, they may hesitate to increase the limit.

Consequences of Exceeding ACH Transfer Limits

Exceeding your established ACH transfer limits can result in penalties and disruptions to your banking services. Understanding these consequences is essential for responsible banking practices.

Penalties for Exceeding Limits

The consequences of exceeding ACH transfer limits can range from temporary account restrictions to significant fees.

| Severity | Description | Fees | Action Taken |

|---|---|---|---|

| Minor Exceedance | A small amount over the limit. | Potentially a small fee. | Warning or notification. |

| Moderate Exceedance | A significant amount over the limit. | Higher fees, potentially impacting future limits. | Temporary suspension of ACH transfer capabilities. |

| Severe Exceedance | A substantial amount over the limit, potentially indicative of fraudulent activity. | Significant fees, potential account closure. | Account suspension, investigation, potential legal action. |

Comparing CIT Bank ACH Limits to Competitors

Comparing CIT Bank’s ACH limits to those of other major banks provides context and helps understand the competitive landscape.

| Bank Name | Daily Limit | Weekly Limit | Monthly Limit |

|---|---|---|---|

| CIT Bank (Example) | $10,000 (Personal), $50,000 (Business) | $25,000 (Personal), $125,000 (Business) | $50,000 (Personal), $250,000 (Business) |

| Bank of America (Example) | $25,000 | $50,000 | $100,000 |

| Chase (Example) | $25,000 | $75,000 | $150,000 |

| Wells Fargo (Example) | $20,000 | $50,000 | $100,000 |

These are example limits and may vary based on account type and individual bank policies. The differences reflect varying risk assessments and target customer bases. For instance, banks catering to large businesses might offer substantially higher limits than those focused on individual consumers.

Security and ACH Transfers

CIT Bank employs robust security measures to protect ACH transfers from fraud and unauthorized access. Customers also play a vital role in safeguarding their accounts.

CIT Bank’s Security Measures

Source: ftcdn.net

CIT Bank utilizes various security protocols, including encryption, fraud detection systems, and multi-factor authentication, to protect ACH transfers. Specific details of these measures are generally not publicly disclosed for security reasons.

Protecting Against Fraudulent ACH Activity

Source: ivetriedthat.com

Customers can take several steps to protect their accounts:

- Monitor Account Statements Regularly: Review your account statements for any unauthorized transactions.

- Use Strong Passwords and Multi-Factor Authentication: Protect your online banking access with strong passwords and enable multi-factor authentication whenever possible.

- Be Wary of Phishing Attempts: Never share your banking information in response to unsolicited emails or phone calls.

- Report Suspicious Activity Immediately: Contact CIT Bank immediately if you suspect any fraudulent activity.

Common ACH Transfer Scams and Prevention

Several common ACH scams exist. Awareness and vigilance are crucial for prevention. Examples include business email compromise (BEC) scams, where fraudsters impersonate businesses to trick individuals into sending payments to fraudulent accounts.

Ultimate Conclusion

As we conclude this exploration of CIT Bank ACH transfer limits, remember that navigating these financial currents is not merely a technical exercise, but a reflection of your inner alignment. By understanding the interplay between your actions and the system, you can cultivate a harmonious relationship with your finances, ensuring a steady and abundant flow of resources. Embrace the wisdom gained, and may your financial journey be marked by clarity, balance, and effortless prosperity.

The path to financial freedom is paved with understanding, and this understanding unlocks a gateway to greater abundance.